MicroStrategy’s Bitcoin Investment is at a >$850 million loss

The leading news source for cryptocurrencies and Bitcoin; Watcher Guru, tweeted on their official Twitter handle: “MicroStrategy’s #Bitcoin investment is currently at an $850 million loss”.

The American company that provides business intelligence (BI), mobile software, and cloud-based services; MicroStrategy was founded in 1988 by Michael J. Saylor; one of the world’s most famous Bitcoin supporter. In August 2020, MicroStrategy announced that it will adopt bitcoin as its treasury reserve asset, stating that bitcoin is a dependable store of value and attractive investment with greater long-term return potential compared to holding cash.

Even though many were not in support of the company’s decision to invest in digital assets considering the fact that cryptocurrencies are very volatile in nature, this did not change their view towards bitcoin.

From the time of the company’s official announcement till this time of writing; Microstrategy has purchased over 130,000 bitcoins in holdings.

What happened to the price of Bitcoin?

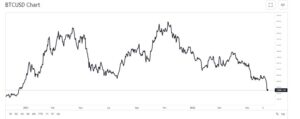

Bitcoin’s price has fallen as inflation hit a new 40-year high. Inflation had its fastest increase since December 1981; summing up to 8.6% in May. According to experts, the major cause of this high inflationary rate is the continuous war between Russia and Ukraine; and how it has caused the Fed to tighten monetary policies (increasing interest rates). The price of Bitcoin has dropped 70% in value since its all-time high of $68,000 on November 10, 2021.

What are the Bitcoin supporters saying?

Despite the current situation with the crypto market, some investors in bitcoin have proven to be less concerned with its current dipping. Michael Saylor, the founder of MicroStrategy and a bitcoin maximalist has taken to his Twitter page to continuously express his never-dying support for bitcoin. He is not alone in this as Venture capitalist Tim Draper and U.S. Senator Ted Cruz have also expressed their bullish view toward bitcoin.

In contrast to their view, Chief Economist and Global Strategist; Peter Schiff has stated that he is in no support of bitcoin. Unlike Saylor, the radio personality has proven to be a gold chrysophilist; and he has warned people not to buy this dip.

Financial expert’s advice on how to cope with the crypto dip.

According to Bill Noble; the chief technical analyst at Token Metrics, investments in cryptocurrencies should be kept to 5% of your portfolio. As long as your investment in crypto does not affect your other financial sectors and you are only investing what you can afford to lose, Humphrey Yang, a personal finance advisor recommends that you set it and forget it. (As long as you are investing in the right coins).

In essence, don’t use money meant for other responsibilities to invest in crypto, only use what you can afford to lose, and make sure you are comfortable losing it. Avoid checking your investment during this volatile market as it may cause you to act on fear. If you follow these recommendations and keep your emotions in check, surviving a crypto bear market won’t be so hard.